Medicare Advantage Agent for Beginners

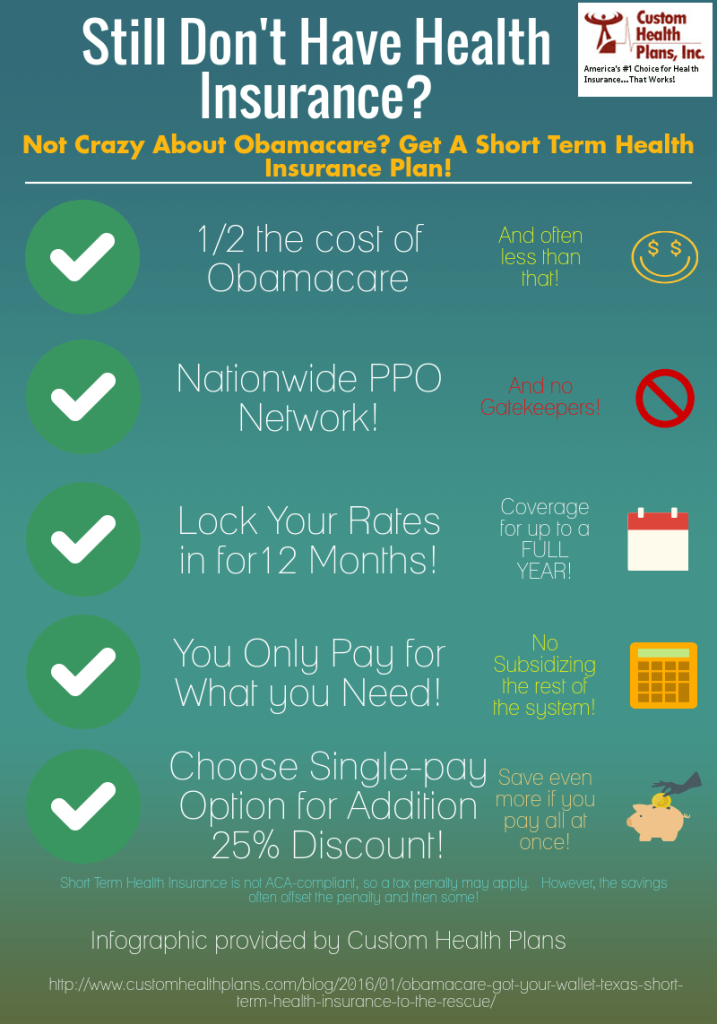

You can use this duration to sign up with the strategy if you didn't previously. Plans with greater deductibles, copayments, and coinsurance have lower costs.

Call the marketplace for more details. If you purchase from an unlicensed insurer, your claim might go unsettled if the business goes damaged. Call our Customer service or visit our web site to examine whether a firm or representative has a license. Know what each plan covers. If you have physicians you intend to maintain, see to it they remain in the plan's network.

Not known Facts About Medicare Advantage Agent

Also make certain your medications get on the strategy's listing of approved drugs. A plan will not pay for medications that aren't on its list. If you exist or leave something out on objective, an insurer may terminate your insurance coverage or refuse to pay your cases. Use our Health strategy buying guide to shop clever for health and wellness coverage.

The Texas Life and Wellness Insurance coverage Warranty Organization pays claims for wellness insurance. It doesn't pay cases for HMOs and some various other kinds of plans.

Your partner and children additionally can proceed their coverage if you go on Medicare, you and your spouse separation, or you pass away. They should have gotten on your prepare for one year or be younger than 1 years of age. Their protection will certainly finish if they obtain other insurance coverage, don't pay the premiums, or your employer quits supplying health insurance policy.

The Greatest Guide To Medicare Advantage Agent

If you proceed your protection under COBRA, you need to pay the premiums on your own. Your COBRA insurance coverage will be the same as the coverage you had with your employer's plan. Medicare Advantage Agent.

Once you have enrolled in a health insurance plan, make certain you recognize your strategy and the expense ramifications of different procedures and solutions. Going to an out-of-network doctor versus in-network traditionally costs a consumer much more for the very check that same kind of service (Medicare Advantage Agent). When you enroll you will certainly be provided a certificate or evidence of insurance coverage

10 Easy Facts About Medicare Advantage Agent Described

It will additionally inform you if any kind of services have limitations (such as optimum amount that the health insurance will pay for durable clinical equipment or physical treatment). And it needs to inform what services are not covered in any way (such as acupuncture). Do your homework, study all the options readily available, and evaluate your insurance plan prior to making any type of choices.

The smart Trick of Medicare Advantage Agent That Nobody is Talking About

When you have a medical treatment or go to, you generally pay your health treatment service provider (medical professional, medical facility, specialist, etc) a co-pay, co-insurance, and/or a deductible to cover your section of the company's bill. You expect your health insurance plan to pay the remainder website link of the bill if you are seeing an in-network company.

Nonetheless, there are some cases when you may have to sue yourself. This could occur when you most likely to an out-of-network carrier, when the service provider does not accept your insurance policy, or when you are taking a trip. If you require to submit your very own medical insurance claim, call the number on your insurance coverage card, and the client assistance rep can educate you just how to file a claim.

Numerous health plans have a time frame for the length of time you have to file an insurance claim, usually within 90 days of the solution. After you file the insurance claim, the health insurance plan has a restricted click this link time (it varies per state) to inform you or your company if the health insurance has accepted or refuted the case.

See This Report on Medicare Advantage Agent

For some wellness plans, this clinical necessity decision is made prior to treatment. For various other health plans, the choice is made when the company obtains a costs from the company.